Target Health

Our Clinic

Insurance and Direct Billing Information

Many of our clients have private health insurance that covers paramedical services, including massage therapy. While we cannot guarantee direct billing to all insurance companies, we always strive to accommodate our clients to the best of our ability.

Common Coverage Options

Insurance plans can vary widely, but here are some of the more common options:

-

Full coverage of treatment: Insurance covers the entire cost of the treatment.

-

Full coverage minus a deductible: Insurance covers the treatment cost after a deductible is applied.

-

Coverage per session: Insurance covers a certain dollar value per session, regardless of treatment length or cost.

-

Percentage of cost: Insurance covers a certain percentage of the treatment cost.

Referral Requirements

Some insurance plans require a referral from a medical professional (MD or NP) before they will cover the treatment. This varies by plan and is determined by your employer or the insurance administrator.

-

If your plan requires a referral, you’ll need to pay for the first session out of pocket. You can then submit the referral and the invoice directly to your insurance for reimbursement.

-

For subsequent treatments, direct billing should be possible. However, some plans may allow the clinic to submit the referral along with the first visit, but this is not guaranteed. Please check with your insurance provider for clarification.

What Happens if the Full Amount is Not Covered?

If the insurance plan does not cover the full cost of a session:

-

You will be responsible for paying the remaining balance.

-

In some cases, we may be able to direct bill a second insurance company (if you have one), but this depends on whether the primary and secondary insurance plans allow coordination of benefits.

Electronic Billing and Claims

-

Some insurance plans do not support electronic submissions for direct billing. If you’re unsure whether your plan supports this, please contact your insurance company directly.

-

Sometimes claims will be listed as “pending” immediately after submission. If this happens, we will void the claim, and you will need to pay for the session upfront. You can then submit the invoice directly to your insurance for reimbursement. This is most common with first-time visits, but subsequent claims are typically smoother.

First Visit and Insurance Information

For your first visit, we request that you complete the insurance information section on our intake form. You may also bring your benefit details to the appointment.

-

After your first visit, we will add a note to your file regarding your insurance provider and typical coverage amount for future visits.

-

If there are any changes to your insurance due to employment or relationship changes, please inform your therapist at the start of your next visit.

Privacy and Coverage Details

-

Insurance companies will not disclose the remaining balance of your annual benefits to clinics or practitioners. To find out your remaining coverage, please contact your insurance company directly. Many now offer apps for easy access to this information.

Plan Reset Timelines

-

Insurance policies often reset at different times throughout the year. While most reset on January 1st, other policies may reset based on your hire date, employer’s fiscal year, or other factors. You are responsible for knowing when your plan resets, as clinics do not have access to this information.

Invoices and Health Spending Accounts

-

If you need a copy of an invoice from a prior visit, please contact the clinic, and we will provide one.

-

Some plans also include Health Spending Accounts that go beyond paramedical coverage. If you have such an account, you will need to pay for treatments upfront and then submit the receipts to your insurance for reimbursement.

Coordination of Benefits

Spouse/Partner Insurance:

-

-

The individual receiving treatment should use their primary insurance first.

-

If there’s a remaining balance after the primary insurance is applied, it can potentially be submitted to the secondary insurance.

-

If both insurance policies are with the same provider (like Alberta Blue Cross), the insurer’s portal may handle this automatically.

-

Even if the spouse/partner’s insurance provides better coverage, the primary insurance (the client’s own) must be used first.

-

Youth/Adult Student Under Parent’s Insurance:

-

-

Claims are generally processed through the insurance policy that the family has had longest.

-

After applying the primary insurance, the remaining balance can be submitted to the secondary insurance.

-

Ineligibility for Secondary Insurance Submission:

-

Sometimes, even after the primary insurance is processed, it may not be possible to submit the remaining balance to secondary insurance.

-

In these cases, the clinic will provide an invoice with a breakdown of covered amounts and the remaining balance.

-

The client can then submit this invoice to their secondary insurance for potential reimbursement of the balance paid.

This system can get a bit complex, but these steps should help clarify the process when working with multiple insurance sources.

A list of insurance companies we may be able to direct bill

Common Insurance Companies:

-

Alberta Blue Cross

-

Canada Life (formerly Great-West Life)

-

Desjardins Insurance

-

Greenshield

-

Industrial Alliance

-

Manulife

-

Medavie Blue Cross

-

Sunlife

Recently Added:

-

Saskatchewan Blue Cross

-

Manitoba Blue Cross

-

PBAS (SAITSA)

Other Insurance Companies (Alphabetical Order):

-

BPA – Benefit Plan Administrators

-

**Canadian Construction Workers Union

-

Chamber of Commerce Group Insurance

-

CINUP

-

ClaimSecure

-

Coughlin & Associates LTD.

-

Cowan

-

D.A. Towny

-

Empire Life

-

Equitable Life of Canada

-

First Canadian

-

GMS Carrier 49

-

GMS Carrier 50

-

Group Health

-

Group Source

-

Johnson Inc.

-

Johnson Group Inc.

-

La Capitale / Beneva

-

LiUNA Local 183

-

LiUNA Local 506

-

Manion

-

Maximum Benefit

-

MEDIC Construction

-

NexgenRx

-

People Corporation

-

RWAM Insurance Administrators

-

SSQ Insurance

-

TELUS AdjudiCare

-

The Co-operators

-

Union Benefits

-

UV Insurance

Who at Target Health handles direct billing?

Practitioners who can direct bill all listed insurance companies:

-

Dino Gradilone

Practitioners who can direct bill some companies, but not all:

-

Lasheka Morgan

(If you see one of these therapists, make sure to check with them directly to confirm which insurance companies they can direct bill before your appointment.)

Practitioners who cannot direct bill at this time:

-

Chad Van Ellenberg (Osteopath)

-

Hailey Covello (Aesthetician)

-

Jennifer Nguyen (Counseling Services)

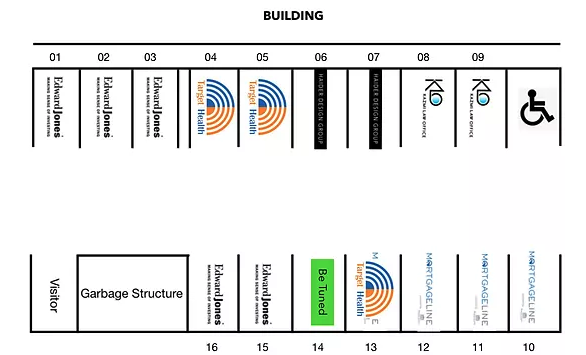

We have moved!

1724 46 Street NW – Only 2 Blocks from our previous location.

We now have 3 designated parking spots in the back lot: stalls 4, 5, and 13.

If your appointment is before 4:00 PM on weekdays, please park only in these spots or use any available street parking around the clinic. After 4:00 PM on weekdays and at any time on weekends, you may park in any available spot.